Why invest in Risk Intelligence?

A fully scalable growth model

2025 Strategy:

An investment in a worldwide scalable model

Strong global positioning

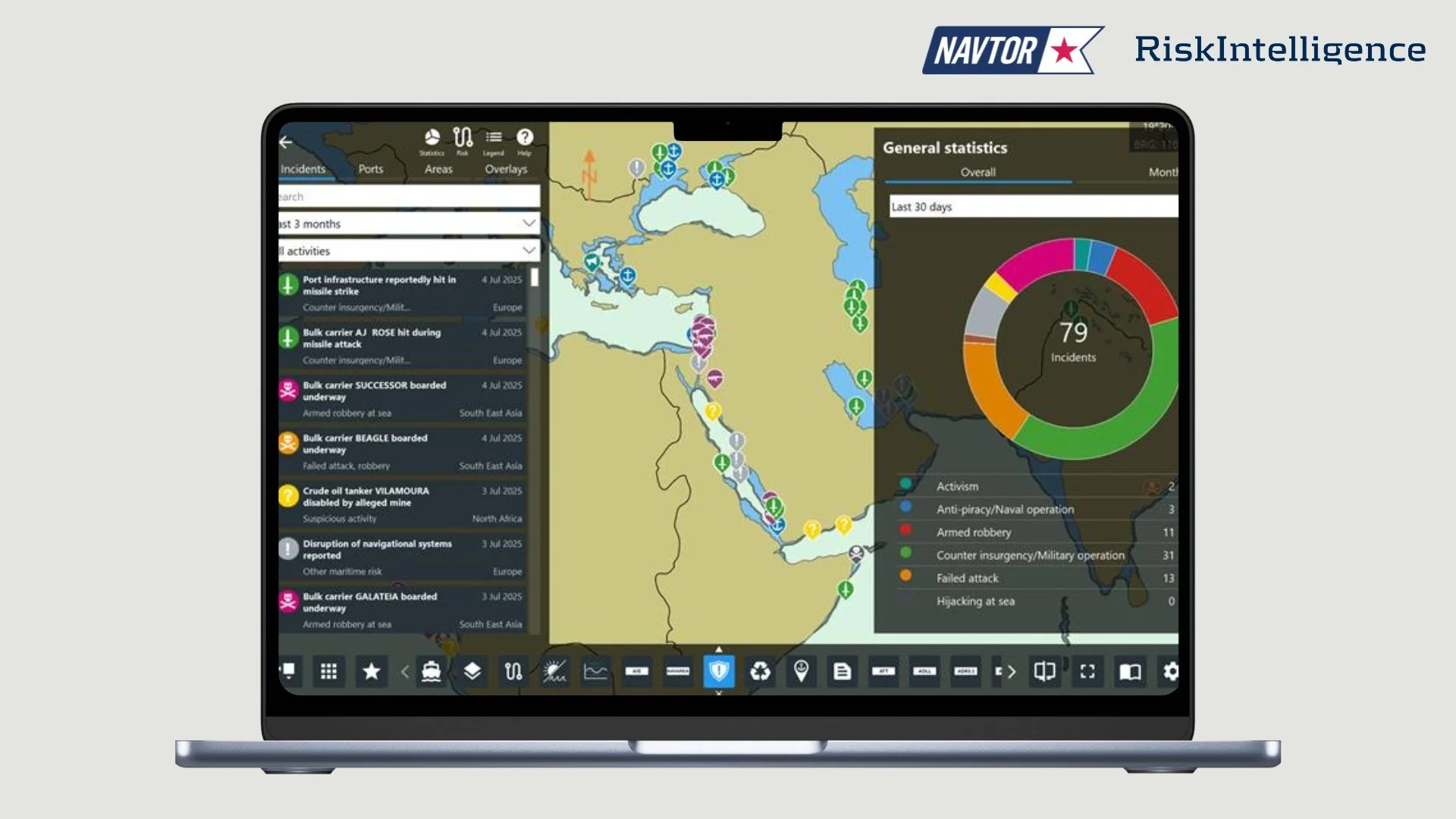

Risk Intelligence A/S is recognised as a leader within security risk intelligence and the company delivers threat and risk assessments globally. The business model is designed to scale with a digital product at the core, powered by specialist risk intelligence analysis and in continuous development to cover emerging threats and trade patterns.

Agile and scalable business model

The company’s core product, the Risk Intelligence System, is a digital, intelligence-powered risk monitoring and planning system, that allows clients throughout the end-to-end supply chain to monitor global security risks in integration with their fleet management systems. It is constantly developed in close collaboration with clients and is fully scalable.

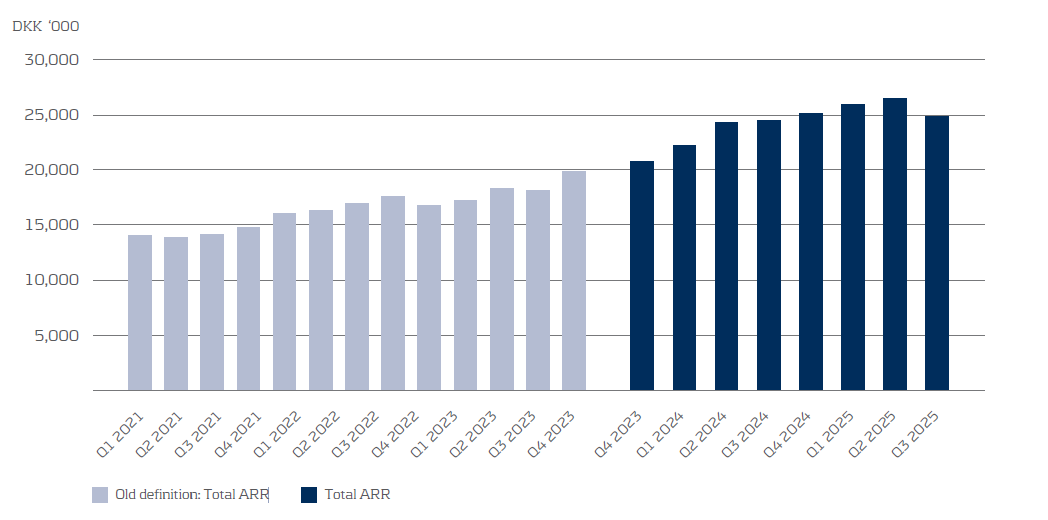

Strong, recurring license revenue

Risk Intelligence System license agreements provide access to the System, and are paid annually, in advance. The license agreements are priced according to number of users and modules included. With a historic renewal rate of 98-99% (churn of 1-2%), each new license improves future cash flow with an average recurring revenue value of DKK 1.5 million (LTV).

Five reasons to invest in Risk Intelligence:

The business model is global and fully scalable

The company is a well-known, established leader in its field

The core product is AI enabled, strengthening scalability

The yearly licences provide strong, recurring revenue

The churn is 0-4% and recurring revenue is in strong growth

Total ARR quarter by quarter 2021-2025

What do we do?

Risk intelligence may not be the easiest product to understand. Who needs it? What is the potential?

But seen in the context of global trade, and the many dangers a product, component or raw material is exposed to as it travels across the planet to its final destination, the demand for our Risk Intelligence System and advisory products becomes clear:

Any company dependent on the global supply chain needs up-to-date intelligence to keep its assets, vehicles, vessels and, not least, people safe.

Share information

Trading abbreviation

RISK

ISIN-/Trading code

DK0061031978

Number of shares

25,986,757

Votes each

1

Denomination per share

DKK 0.10

Share Capital

DKK 2,598,675.7

Free float

73%

First day of trading

17 August 2018

Link to Spotlight

Go to Spotlight Stock Market

Link to Shareholder Portal

Shareholder Portal

Financial calendar

25 February 2026 Q4 and 2025 Year-end Report

24 April 2026 Annual General Meeting

20 May 2026 Q1 2026 Interim Report

19 August 2026 Q2 2026 Interim Report

18 November 2026 Q3 2026 Interim Report

24 February 2027 Q4 and 2026 Year-end Report

Press releases